Tax Bracket 2024 Philippines – Both federal income tax brackets and the standard deduction have increased for 2024. This change is in response to sticky inflation, which has kept prices high all year. The higher amounts will . A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective tax rate would be much lower .

Tax Bracket 2024 Philippines

Source : www.aarp.org

UPDATED: Income Tax Tables in the Philippines and TRAIN Sample

Source : www.pinoymoneytalk.com

TRAIN law to further reduce personal income taxes in 2023 onwards

Source : www.dof.gov.ph

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

City of Manila Local Government System

Source : www.cityofmanila.ph

Department of Finance ICCP: CREATE IS THE THE LARGEST FISCAL

Source : www.facebook.com

Budget FY24: Use our calculator to find out how much tax you will

Source : www.dawn.com

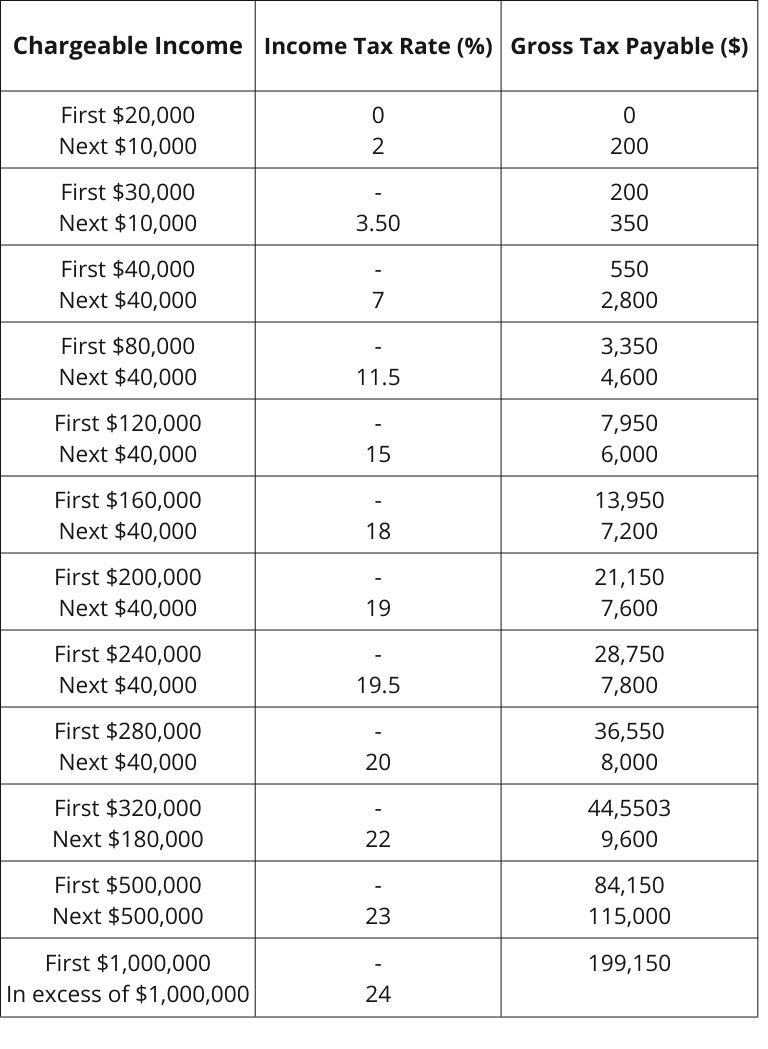

Singapore Individual Income Tax Rate Diacron

Source : www.diacrongroup.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Tax Bracket 2024 Philippines IRS Sets 2024 Tax Brackets with Inflation Adjustments: Your tax bill is largely determined by tax Siege A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed . Your paycheck could be slightly bigger in 2024 due to federal income tax bracket adjustments, experts say. However, you should still review your federal and state withholdings throughout the year .